Goal Based Financial Planning

What is financial planning?

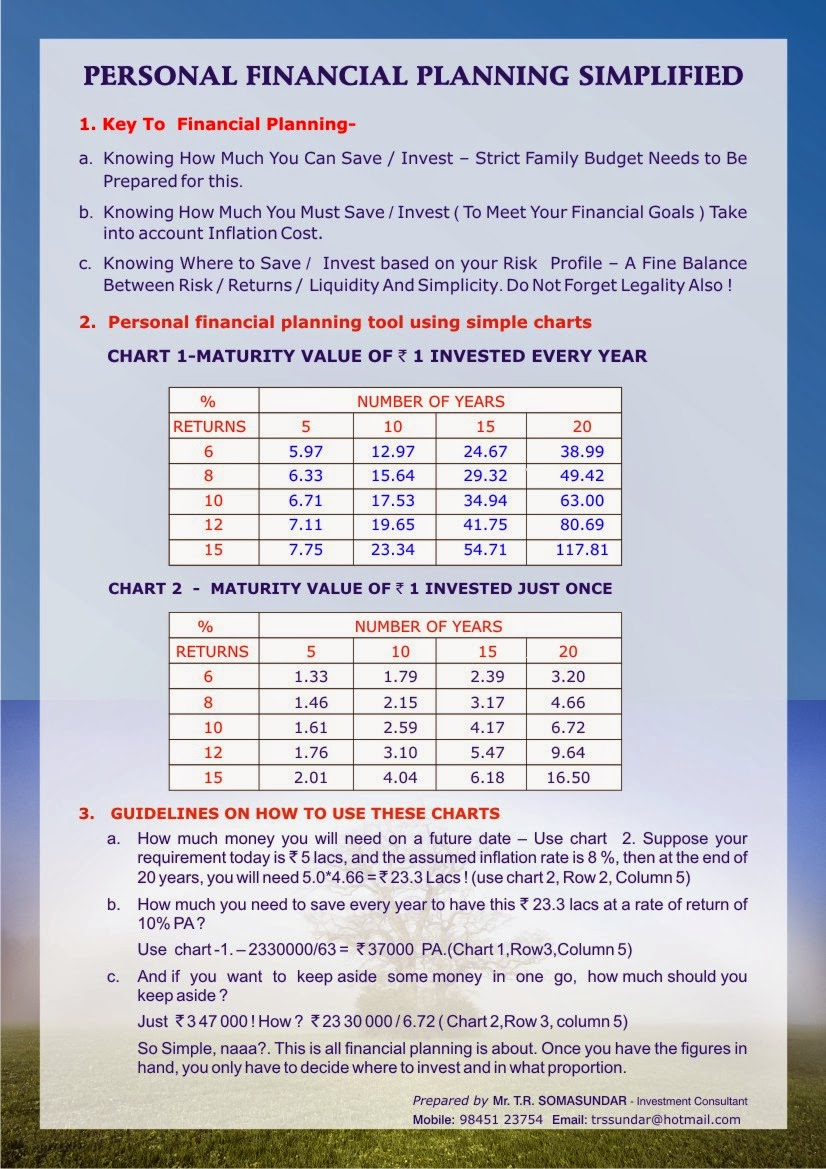

Financial planning is the process of defining different goals, quantifying these goals factoring in inflation and having an investment plan to meet these goals.

What are the steps in financial planning?

Setting goals:

Financial planning is not just for retirement. You should lay-out all your goals in different stages of life, e.g. purchasing car, property, paying off loans, children's higher education, children's marriage, retirement planning, leaving a legacy for your children and grandchildren etc. You should always factor in inflation, when setting financial goals.

Financial planning and goal based investing is essentially one and the same thing. You should always invest according to your financial goals. Let us illustrate this with an example - You want to save Rs 2 crores for your retirement based on current prices. Let us assume that you are 25 years old and you will retire at the age of 60 years. Suppose the average inflation rate over the next 35 years is 5% and you expect 12% annualized returns - you need to have a corpus of Rs 11.3 crores by the time you retire. How much do you need to invest to meet your financial goal? You will have to save monthly Rs 19,016 through mutual fund SIPs to meet this goal.

Assess your risk appetite:

Risk refers to an adverse financial outcome against your expectations. Some people have higher capacity to take risks than others. Your risk appetite depends on your age, stage of life, personal and financial situation. For example, a young working woman will have higher risk appetite compared to someone who is close to retirement or some other major life-goal e.g. children's higher education. A working woman in a double income family will have higher risk appetite compared to a single mother. Home-makers with salaried spouses will have different risk appetites compared to home-makers in business families. You should always invest according to your risk appetite.

Asset allocation and selecting appropriate products:

Different asset classes have different risk profiles, e.g. equity has a higher risk profile compared to gold or fixed income. Remember that investment risk and returns are interrelated - higher risk, higher returns in the long term and vice versa. You should invest in the right asset class depending on your financial goal and risk appetite. Within each asset class e.g. equity, fixed income etc, different products have different risk profiles e.g. midcap funds have higher risk compared to large cap funds and so on.

Prepare an investment plan:

Investment plan is essentially knowing how much to invest, when / how frequently to invest and where to invest. Once you know your goals, risk appetite and asset allocation profile most of the job is done. The rest of the job is simply to calculate how much you need to save and invest based on goal amount, goal horizon and expected return on investment. You can take our help for making an investment plan.

Start investing:

This is the most important step in the process. An investment plan which is just on paper or spreadsheet is useless unless you start executing on it. Do not despair and give up if the calculated investment amount is more than what you can afford. Start with whatever you can save and invest now. Increase your investments over time as your income and savings grow. The earlier you start investing, irrespective of amounts, higher is your chance of succeeding in your financial goals.

Regularly review your financial plan:

Your financial plan is not cast in stone. Over time, your financial and personal situation can change. Accordingly, your income and goals will also change. It is always prudent to regularly review and adjust your financial plan. Financial planners suggest an annual review of financial plans. You can do it more or less frequently depending on your personal preference, but you should ensure that your financial plan is largely aligned to your aspirations and financial situation.